Global Lithium Supply Chain Faces Systemic Risks from Network Complexity and Geopolitical Tensions

A groundbreaking study involving researchers from the RISE team at Peking University and SMILE Lab from SDU reveals the hidden vulnerabilities in the global lithium supply chain network, a critical component for achieving carbon neutrality goals. The research, published in Environmental Science & Technology, demonstrates how highly interconnected supply chains exhibit a “robust yet fragile” paradox—resilient to random shocks but vulnerable to targeted disruptions.

The Lithium Challenge

Lithium is essential for electric vehicle batteries and the global energy transition. However, the geographical mismatch between production and consumption regions, combined with highly concentrated supply sources and complex global trade networks, exposes the supply chain to unprecedented risks—from trade restrictions and resource nationalism to natural disasters and geopolitical conflicts.

Innovative Methodology

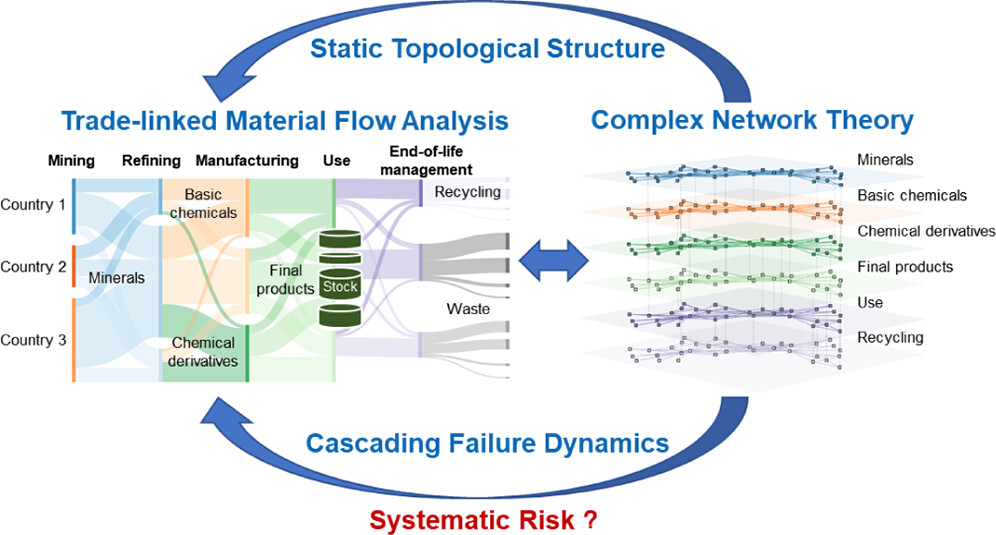

The research breaks new ground by combining trade-linked material flow analysis with multi-layer network modeling, creating a comprehensive map of the global lithium supply chain across six life cycle stages: ore, basic chemicals, chemical derivatives, final products, use, and recycling. The team extended traditional static network metrics (degree centrality, closeness centrality, betweenness centrality, eigenvector centrality, PageRank, and Laplacian centrality) to multi-layer networks and adapted dynamic cascading failure models to directed, weighted multi-layer networks.

Key Findings

Highly Interconnected but Geographically Concentrated

In 2022, the lithium supply chain multi-layer network comprised 865 nodes across 225 countries and 6 life cycle stages, with 14,362 intra-layer links (trade relationships) and 634 inter-layer links (production, processing, and consumption relationships). Critical statistics include:

- 45% of global lithium ore (83 kt out of 183 kt) enters international trade, with Australia-to-China flows dominating at 79 kt

- 55% of basic lithium chemicals (119 kt out of 218 kt) are traded internationally with Chile, Argentina, Netherlands, and China as major exporters, while South Korea, Japan, and the US are primary importers

- China exports approximately 30 kt of chemical derivatives and 10 kt of final products

Australia, China, Chile, Japan, South Korea, the US, and the EU play pivotal roles, creating both efficiency and vulnerability.

“Robust Yet Fragile” Network Characteristics

The study identified different node types based on their roles in risk propagation:

- Risk Propagation Hubs (high degree centrality): Absorb random shocks but amplify targeted disruptions

- Risk Amplifiers (high closeness centrality): Spread local disturbances via shortest paths

- Risk Bridges (high betweenness centrality): Connect suppliers and consumers; disruption can fragment the network

- Network Stabilizers (high Laplacian centrality): Maintain overall connectivity

- Influential Risk Propagators (high eigenvector/PageRank): Highly connected with significant destructive potential

China-US Decoupling Scenarios

The study simulated various degrees of China-US supply chain decoupling, revealing systemic implications:

Direct Impact:China-US lithium trade represents only 3% of global trade volume, so even 100% decoupling would not improve the US’s systemic risk position.

Indirect Impact:The cascading effects are substantial:

- In 100% decoupling scenarios:

- 61 countries see increased dynamic criticality (7% of global total)

- 73 countries experience increased dynamic vulnerability (7% increase)

- Germany, Poland, Hungary gain criticality at the expense of India, Vietnam, Australia

- Chile, India, Canada reduce vulnerability; Malawi, Mexico, Slovakia, Ukraine increase

- Most decoupling scenarios (50–100%) increase global systemic risk by ~5%

- However, 25% decoupling could reduce global dynamic vulnerability by 8.26%, with only marginal increase in criticality → suggesting partial decoupling may balance efficiency and security

Policy Implications

The research calls for global cooperation and collective efforts to avoid “zero-sum games” in securing lithium supply chains. As geopolitical tensions intensify and supply chains shift from global integration toward diversified confrontation, policymakers must move beyond simple diversification strategies toward strategic network topology optimization that balances efficiency and security. Countries with high vulnerability need both internal optimization to improve self-sufficiency and external cooperation to integrate their domestic industries into regional and global supply chain networks, enhancing their competitive position and bargaining power.

Read the full paper

Environmental Science & Technology is a leading international journal covering environmental science, technology, and policy research. Published biweekly by the American Chemical Society since 1967, it has an impact factor of 11.357 (2022–2023).